Additional Info

As a result of filing the FAFSA, you will receive a FAFSA Submission Summary by email. You have the ability to access your FAFSA Submission Summary by going to StudentAid.gov. You will need your FSA ID to access the summary.

Review the summary for accuracy. If you need to make any corrections, you may do so by going to StudentAid.gov. You will always need your FSA ID (and your parent’s, if dependent) to access, make corrections and sign electronically.

When you make corrections, Marshall University and, (if you are a WV resident) the WV Higher Education Policy Commission will automatically receive these updates electronically. It takes one to two weeks before the corrections are processed and received by the school and the state.

If you have already received an award notice from Marshall University and you make corrections to the FAFSA, you will receive a revised award notice if your eligibility has changed.

If you don’t receive confirmation of the FAFSA submission summary within a week of filing, you may access your summary by going to StudentAid.gov. You will need your FSA ID to access and print. You may also call the Federal Student Aid Information Center at 1-800-4-FED-AID (1-800-433-3243) to make an inquiry about your financial aid application.

Upon receipt of your FAFSA by the FAFSA Processing System (FPS), some of the information on your FAFSA will be checked with federal agencies to confirm that you meet basic eligibility requirements. The following student eligibility criteria are checked:

- Social Security number and citizenship status with the Social Security Administration

- Eligible non-citizenship status with the U.S. Department of Homeland Security

- Veteran Status with the U.S. Department of Veteran Affairs

- Default, disability discharge, bankruptcy, aggregate loan history statuses for federal student loans, and overpayment status for federal student grants.

The Office of Student Financial Assistance must also review other eligibility requirements, which include, but are not limited to:

- Admission Status

- Satisfactory Academic Progress

- Enrollment Status

- Academic Level

- Dependency Status

- Marital Status

- Enrollment at another college (unusual enrollment history)

If any of these items come up as discrepant, the Office of Student Financial Assistance is required to resolve the issue. This may require the Office of Student Financial Assistance to follow up with you to request documentation to resolve any of the eligibility issues referenced above.

Verification is the process in which Student Financial Assistance (SFA) – as dictated by federal and state regulations – compares the information you reported on the FAFSA with your prior-year IRS Federal Income Tax Transcript, W-2 forms, and other financial documentation.

What Can Students Expect?

If your application is selected for verification, you will be sent a letter or an email instructing you to log onto mymu.marshall.edu to review your outstanding financial aid requirements. You will need your Marshall University User Name and your Marshall University password to access your records. From there you can determine the specific information SFA needs in order to verify your data.

SFA must receive all requested documentation before your financial aid can be disbursed (or credited) to your student account. If there are differences between the data you supplied on your FAFSA and the verification documentation you submit, corrections to your FAFSA Submission Summary may be needed, and your application will be reprocessed.

Your responsibilities are to:

- Submit all documents requested promptly

- Ensure that all documents are signed and complete and include the student’s name and Marshall University ID

- Keep copies of all information used to file the FAFSA and of documents submitted to the Office of Student Financial Assistance

Satisfactory Academic Progress (SAP) is the term used to define the successful completion of coursework toward a Certificate or Degree to maintain eligibility for financial aid. Marshall University is required by federal and state regulations and institutional policy to determine whether a student is meeting SAP requirements.

SAP for financial aid is monitored on three standards:

- Qualitative: Cumulative GPA in your level of study (undergraduate, graduate, doctoral, etc.)

- Quantitative: Successful pace of completion at a minimum of 67% of all credits attempted in your academic transcript level in undergraduate, graduate programs, Doctor of Pharmacy and Doctor of Physical Therapy. Doctor of Medicine must complete 50% of credits attempted up to 82 credits and 67% over 82 credits.

- Max time frame: Measured based on calendar years for graduate/doctoral students (see details in the policy) and for undergraduate students no more than 180 attempted credit hours for bachelor’s, no more than 100 attempted credit hours for associate (see additional details in the policy).

Students must meet the minimum standards outlined in the applicable SAP policies below to continue to receive financial aid.

To submit an appeal please visit our forms and applications page and select the appropriate award year and term.

Financial Aid SAP Policy for Undergraduate Students

Financial Aid SAP Policy for Graduate Students

Financial Aid SAP Policy for Doctor of Medicine Degree Students

Financial Aid SAP Policy for Doctor of Pharmacy Degree Students

Financial Aid SAP Policy for Doctor of Physical Therapy Students

Some financial aid programs have specific criteria based on the student’s academic (grade) level. According to University Academic Policy, the following criteria are used to define the student’s undergraduate academic level:

| Total Credits Earned | Academic Level |

| 0 – 29 | 1st Year or Freshman |

| 30 – 59 | 2nd Year or Sophomore |

| 60 – 89 | 3rd Year or Junior |

| 90 + | 4th Year or Senior |

Students enrolled in the post-baccalaureate teacher certification program are classified as 5th year undergraduate student.

According to Title IV regulations, if a student is enrolled in courses that do not count toward his or her degree or certificate, they cannot be used to determine enrollment for federal student aid programs unless they are eligible remedial courses. This means that Marshall University may not award a student federal student aid for classes that do not count toward his or her program of study. Each type of financial aid (program) has specific requirements regarding enrollment status. To be eligible for federal loans, you must be enrolled at least half-time. The enrollment criteria listed below is used to determine your eligibility for various financial aid programs.

Undergraduate Enrollment Classification

| Credits Per Term/Semester | Enrollment Status Classification |

|---|---|

| 12 + | Full time |

| 9 – 11 | Three-quarter time |

| 6 – 8 | Half-time |

| 1 – 5 | Less than half-time |

Graduate Student Enrollment Classification

| Credits Per Term/Semester | Enrollment Status Classification |

|---|---|

| 9+ | Full time |

| 5 – 8 | Half-time |

| 1 – 4 | Less than half-time |

As a rule, your financial aid package is originally based on full-time enrollment; however, the Office of SFA uses your enrollment status on the first day after the drop/add period (usually the 8th day of the semester) to determine your financial aid eligibility. Adjustments to your financial aid awards may be required if you enroll less-than full time. Also, only courses leading to your degree requirements may be included in your enrollment status for Title IV (federal) student aid eligibility.

To see details on how developmental/remedial, preparatory, repeat or professional staff development coursework counts towards your program, click the drop-down.

The Student Financial Assistance Office recognizes that some financial aid applicants may have severe extenuating circumstances beyond their control which differentiates them from the majority of students. Accordingly, there is some flexibility and updates can be made to accommodate such students. Financial aid administrators are able to exercise professional judgment on a case-by-case basis to override the student’s dependency status and/or recalculate the student’s eligibility for financial aid. However, this may only be done when the circumstances are extraordinarily unusual and they can be thoroughly documented.

Submitting an appeal for special or unusual circumstances does not guarantee that it will be approved, or additional financial aid will be granted. Your appeal must be received in time for it to be reviewed and approved or denied while you are still enrolled for the academic year. Therefore, it is recommended that you submit your request at least 30 days prior to your last day of enrollment for the current academic year. You will need to allow 2 to 4 weeks processing time for appeals.

Read more information regarding special or unusual circumstances.

You may not receive federal financial aid at more than one institution of higher education for the same courses or at the same time. You must declare which institution is to be considered the “home school” or the institution where you will receive your degree for financial aid eligibility purposes. To be considered for financial aid as a dually enrolled student or a student taking courses elsewhere during a given semester, a consortium agreement form must be completed and approved by both Marshall University and the other school. Marshall University will only approve a consortium agreement when the host institution is a Title IV participating in university or college.

A student may receive student financial aid when participating in a Marshall University-sponsored study-abroad program for which Marshall University awards academic credit. In addition, the credits earned through the study abroad or exchange program must apply toward graduation in the student’s program at Marshall University.

Once a student has been approved by the Study Abroad Office to study abroad in a program sponsored by Marshall University, the student will be registered for study abroad at Marshall University for the given semester or term for administrative purposes. Although the student is taking courses abroad, the student is still considered a Marshall University student for purposes of enrollment certification and financial aid eligibility.

This page provides additional information and requirements for students who wish to receive financial aid educational expenses for study abroad.

The U.S. Department of Education has mandated a regulation limiting payment of federal financial aid only for courses defined as meeting your degree requirements in your selected program of study. Marshall University has adapted and tested our systems to accommodate and track this requirement. To determine if your classes meet this eligibility requirement, please follow the steps below.

Step-by-Step Instructions to Check Your CPoS/Degree Audit Status

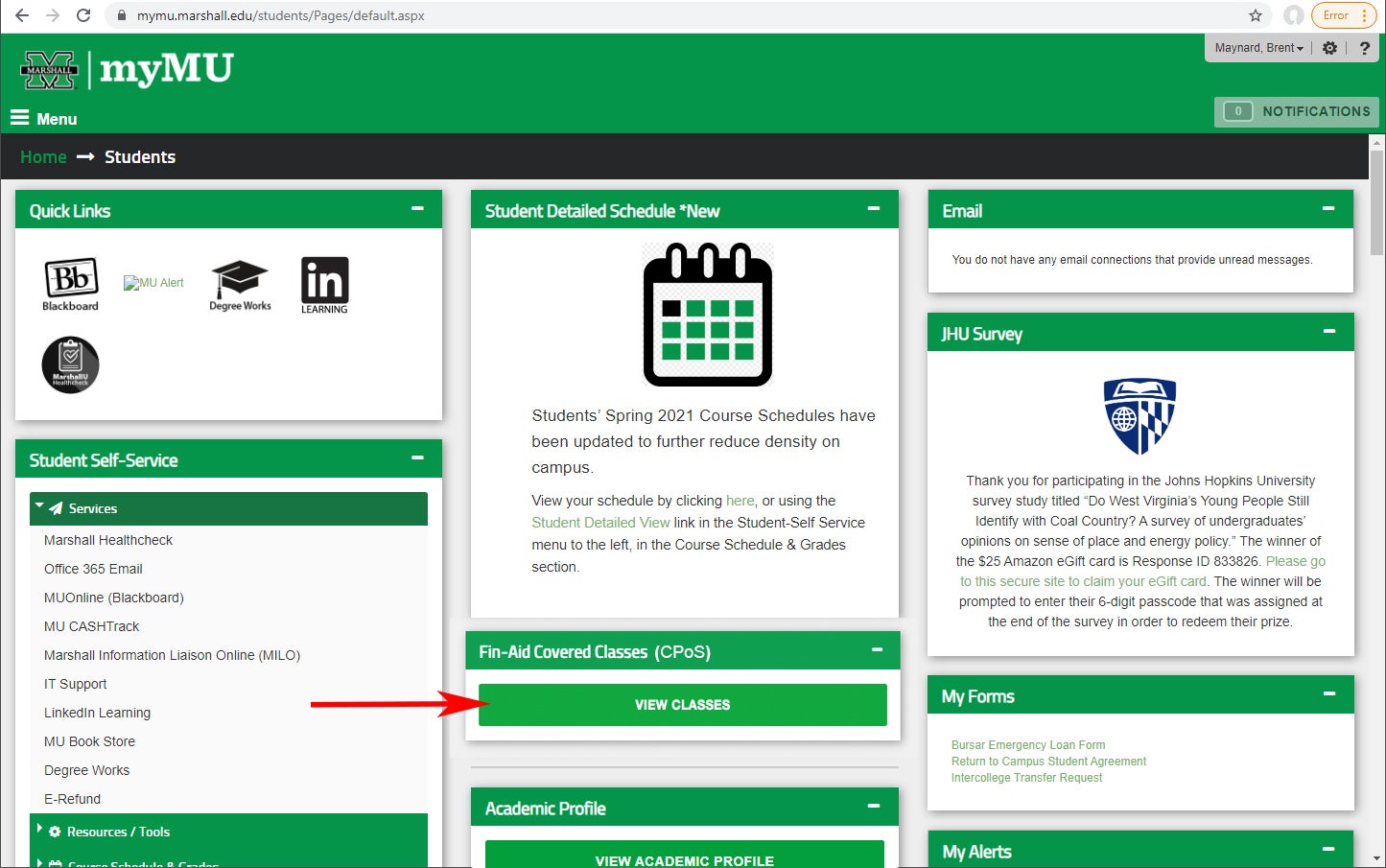

To check your Course Program of Study (CPoS) status, you will log into your myMU account.

Go to the Student Tab (Under Menu), Select Fin-Aid Covered Classes (CPoS).

View your class schedule. Your audit will look something like this:

If a course is not eligible for your program, there will be a “NO” under “Eligible Course”.

Please review your DegreeWorks account located on the student tab of myMU, or your academic map (available at https://www.marshall.edu/advising/curricular-resources/) and adjust your schedule immediately. If you have registration holds or need assistance with a schedule adjustment or determining if your course is allowable in your academic program, please contact your academic advisor.

The Financial Aid Office cannot change your schedule or advise you of what courses will make you in compliance with the Department of Education CPoS rules. Only your Advisor can assist you with this. Your advisor must update DegreeWorks with an override exception if the course should count towards your course program of study.